Negative factors:

Can you imagine that any negative factors would affect cruise line operations? Maybe a virus variant about Covid-19 or the oil prices spiking, or there’s also concern that Russia’s invasion of Ukraine, is that all? Sure, something may have something happened we can’t imagine easily. A market that is so difficult to time, but it is an opportunity when the market got a correction. To be successful, long-term investors in financials must always consider risk. Investors value stock on different risks, today you can buy a stock on undervalue because it has risk. If the prospects are clear, there are no more undervalue.

The price of cruise line:

I won’t show you the chart of a forecast of the EPS or revenue, because no one can predict the market precisely. I thought cruise line stocks remain volatile, but have turned in a positive direction. For example, here are three of the best cruise line stocks, maybe you already passed the best price to collect, but it is time to consider buying when it drips again :

- Carnival (CCL)

- Norwegian (NCLH)

- Royal Caribbean (RCL)

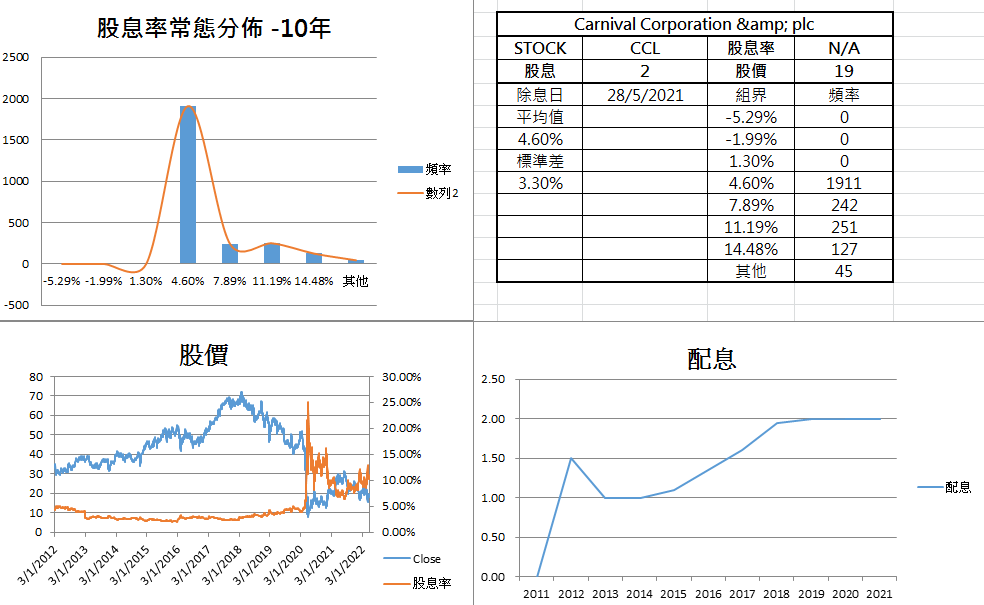

Normal distribution of dividend yield

I try to use the dividend yield of CCL to calculate normal distribution, CCL had no dividends in 2021 and 2022. but we can assume the same level as the pre-pandemic. The dividend yield of CCL has the great possibility to distribute between interval 7.89% to 11.19% when the revenue recovers, that is a good investment chance to wait 2-3 years with no dividend. One more thing, CCL is not a good example to show you why normal distribution is a good reference for investors in dividend stocks. So far I wrote the Chinese version only, maybe later I will try to make another article in English.