Revenues: For the quarter, net revenues grew 10% to $9.5 billion, resulting in net revenues ahead of 2019, and organic revenues (non-GAAP) grew 9%. Revenue performance included 10% growth in price/mix and a decline of 1% in concentrate sales. The quarter included six fewer days, which resulted in an approximate 6-point headwind to revenue growth. The quarter was also impacted by the timing of concentrate shipments. For the full year, net revenues grew 17% to $38.7 billion, and organic revenues (non-GAAP) grew 16%. This performance was driven by 9% growth in concentrate sales and 6% growth in price/mix.

收入按季上升10%,按年上升17%。

Margin: For the quarter, operating margin, which included items impacting comparability, was 17.7% versus 27.2% in the prior year, while comparable operating margin (non-GAAP) was 22.1% versus 27.3% in the prior year. For the full year, operating margin, which included items impacting comparability, was 26.7% versus 27.3% in the prior 1 year, while comparable operating margin (non-GAAP) was 28.7% versus 29.6% in the prior year. For both the quarter and the full year, operating margin compression was primarily driven by a significant increase in marketing investments versus the prior year. Additionally, fourth quarter operating margin was impacted by topline pressure from six fewer days in the quarter along with the timing of concentrate shipments.

營業利潤率按季上升27.2%,按年上升27.3%。

稅後盈餘還是每股淨利按年都上升26%。

按分區來說,稅前收入貢獻最多的是一個叫Bottle Investments的灌漿業務部份,按年上升78%約9億,為什麼會有這麼大的升幅,這個部分感覺不太能夠持續,可能要繼續留意。

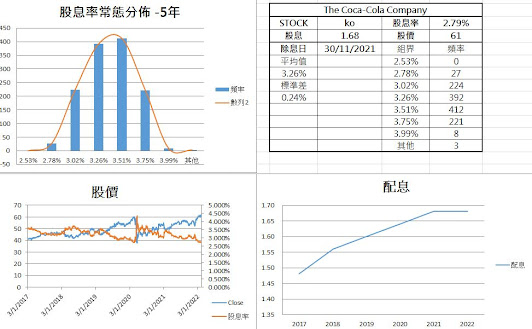

接下來我們算一下股息的分發,現價股息率約2.79%,歷年payout ratio一貫保持在80%的範圍,2021年曾經有達到95%,現在業績有增長,即使全年增長27%,預計股息增長多於10%的機會也不大,我們以1.68×110%=1.848來估算,股價也就是56.68。現價61元是預計股息有18.3%的增長,即全年股息為1.987,每季為0.496,個人會認為這個機會不大,畢竟未來不會是一個容易經營的經濟週期,管理者選擇多留一些資金儲備會更理想。從股價來看,因為consumer defensive板塊和業績增長的關係,股價這一段大升幅已經把價值都price-in進去,現價入場不是一個很好的選擇。